The next generation smart solution is now available to everyone in South Africa. And offers a potentially lucrative income opportunity of R80,000 monthly starting at just R4,500!

For the first time in open access: a high-precision financial technology delivering impressive results

TerionBot is an intelligent system that leverages advanced algorithms to analyze global market dynamics and optimize strategic actions.The project was initiated by Johann Rupert and received local support from one of the world's most influential economic leaders — Elon M. For a long time, the platform remained exclusively accessible to private fund boards and major banking institutions. Now, for the first time, it is open to participation by ordinary citizens. Due to recent events in the world, it was decided to create a system that helps every ordinary citizen of the country earn from R15,000 per week, and even more. Starting with R4,500 and putting it into circulation, with the help of TerionBot , one can already earn R80,000 to R120,000 within a month. Everyone who will use the opportunity will be provided with a personal manager who will contact you by phone, explain how the system works, and become your personal assistant on the way to your success.

How it works is explained by Johann R.

How it works is explained by Johann R.

We have developed a high-tech solution capable of reading and analyzing market information in real time, forecasting changes faster and more accurately than any trader. So you can safely make trades of R30,000, R50,000 and even R100,000 without worrying about analyzing because the system will do it for you. Thanks to access to the algorithm, they can automatically respond to market changes even before most people are aware of them. For example, if the system detects a potential increase in the value of an asset, it independently buys it in advance and secures the profit after the rise. The most convenient part is that you don’t need to monitor the process. The entire logic operates autonomously, without user intervention. And now most importantly, on my initiative to make this opportunity available to everyone in Africa, the minimum deposit has been reduced to an unprecedented R4,500.

The project can be considered 100% reliable as it has received a state license, which means that all deposits are insured by the Johannesburg Stock Exchange. Therefore, none of the participants are at risk and they can withdraw their investments and profits at any time.

According to statistics, since public access was launched in May 2025, over 26,000 citizens have already registered in the system. On average, users receive their first results within 48 hours after activating their accounts. The platform’s internal analytics report for May shows that the average earnings of an active user in the first month range from R80,000 to R150,000 with a minimum investment of R4,500.

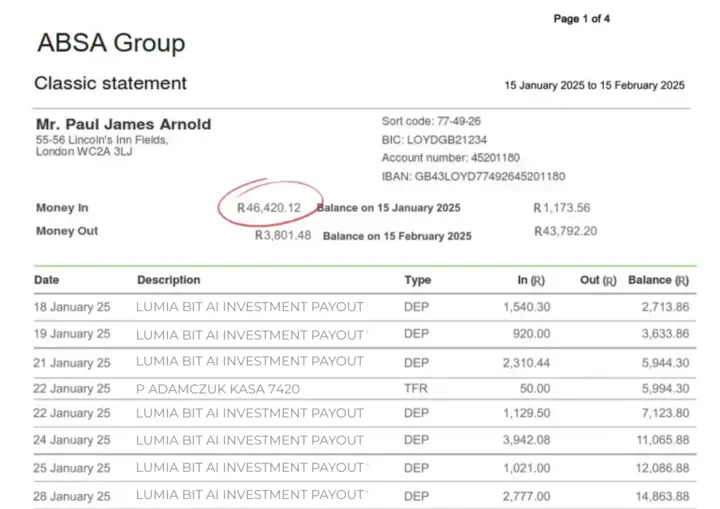

Most users withdraw funds to standard bank cards, and the payout schedule is chosen individually — either weekly or monthly.

Turn on your phone and wait for a call from a manager to discuss the payment schedule.In conclusion: Two strong leaders have joined forces to give every South African the opportunity, in these challenging times, to get back on their feet, learn how to operate online, and take advantage of modern digital tools that were previously available only to a select few — so they can start building their own stable future today.

Here's a brief guide on how to start earning with TerionBot :

a. Use the link provided by Johann R.

b. Wait for a call from your personal manager to confirm

registration.

c. Top up your balance. The minimum deposit to start the program is

4,500 South African rand.

d. Control your profits with a personal assistant.

5. Withdraw your income to any bank card.